Historical Overview

Dubai’s real estate landscape has transformed significantly since 2010 due to economic diversification, infrastructure development, and progressive reforms. Pre-2010, excessive speculation and foreign investment fueled a property boom marked by lavish projects like the Palm Islands. However, the 2008 crisis led prices to halve.

This sparked major policy changes to enable sustainable market growth. Relaxed ownership laws, transparent processes and increased lending revived foreign interest post-2010 as supply issues eased. Key projects like Dubai Opera and the 2020 Expo also positioned Dubai as an attractive global hub.

Despite periodic shocks, proactive planning and world-class infrastructure have now made Dubai’s market resilient, investor-friendly and focused on sustainable expansion.

Current Trends

Dubai’s real estate market is predicted to continue to rise, however at a slower rate than in 2022. Experts expect price hikes of around 4.5% and 3% in 2024 and 2025, respectively according to Real Estate Market Trends 2023 by Dubai Housing.

According to X Reality, house sales are likely to rise further, with a larger demand for ready residences than off-plan. Apartments, especially smaller apartments with one or two bedrooms, remain popular. Dubai’s red-hot real estate market owes its success to business-boosting policies and a prime global position. zero taxes, 100% ownership, hassle-free company registration, good rental returns, and high annual appreciation draws investors in.

Visa incentives allow families to reside long-term, adding lifestyle allure for buyers. With its stable government and forward-thinking cityscape, Dubai has become the real estate hotspot in the Middle East.

Residential Property Types With Prices & Locations

Contrary to popular perception, Dubai’s real estate is more than skyscrapers. The city offers an assortment of residential property types – from luxury villas to high-rise apartments, catering to different classes of investors. Here, we provide an in-depth analysis of these offerings.

● Apartments

These are the most common property types, ranging from small studios to spacious 3+ bedroom units. Typically located in highrise towers across urban neighbourhoods, they offer convenience, shared amenities like gyms and pools, and more affordable pricing per square foot compared to houses. Below are the top locations with ROI & prices for a studio and 1 bedroom apartment for sale in Dubai according to Bayut’s 2023 market report:

● Villas

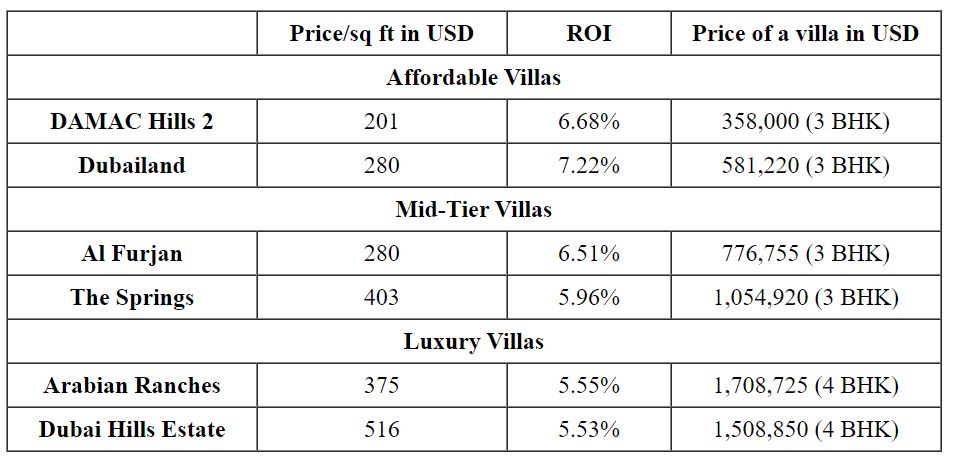

Villas provide the ultimate in privacy, luxury and space as single-family detached homes. With 4 or more bedrooms, private gardens and pools, and premium finishes, they are situated in exclusive villa communities outside the city centre. Below are the top locations with ROI & prices for affordable to luxury villas in Dubai according to Bayut’s 2023 market report:

● Penthouses

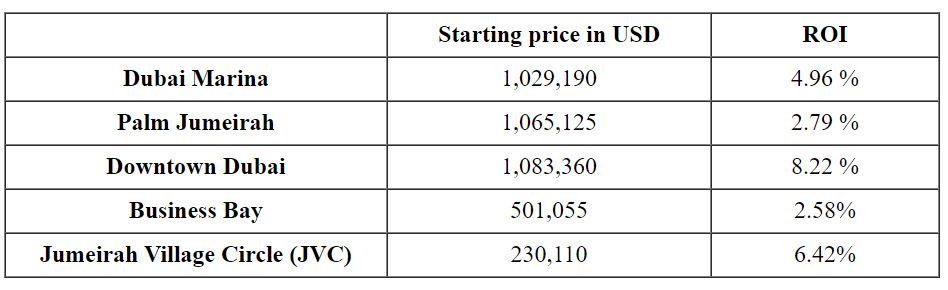

Penthouses represent exclusive apartment-style living on the top floors of highrises. With spectacular views, private elevators, pools, gardens and other luxury amenities, they cater to the ultra-wealthy seeking a posh lifestyle in areas like Dubai Marina, Palm Jumeirah and others. According to Bayut, the top areas to buy Penthouses with starting prices in Dubai:

● Townhouses

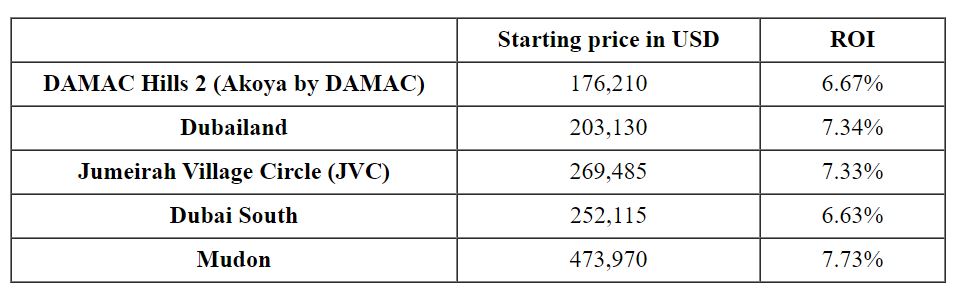

They offer a middle ground – attached 2-3 storey units that share common walls but have their own entrances. Clustered together in communities, they provide more space than apartments for growing families seeking space at lower prices. According to Bayut, the top areas to buy Townhouses with starting prices in Dubai.

The diversity caters to varying needs and budgets – from luxurious exclusivity to convenient, affordable community living within vibrant neighbourhoods.

Growth Prospects

Given positive fundamentals, Dubai real estate appears primed for sustainable growth in the coming years, offering opportunities to savvy investors entering at current valuations.

● Price Growth

After rising by 15.9% in the year leading up to September 2023, house prices in Palm Jumeirah, Emirates Hills, and Jumeirah Bay Island—Dubai’s three “prime” residential areas—are projected by Knight Frank to rise by a more moderate 5% in 2024. Those non-luxury neighbourhoods had a 19% year-to-date increase in home prices till September 2023 and are projected to have a 3.5% growth in 2024.

● Off-Plan Projects

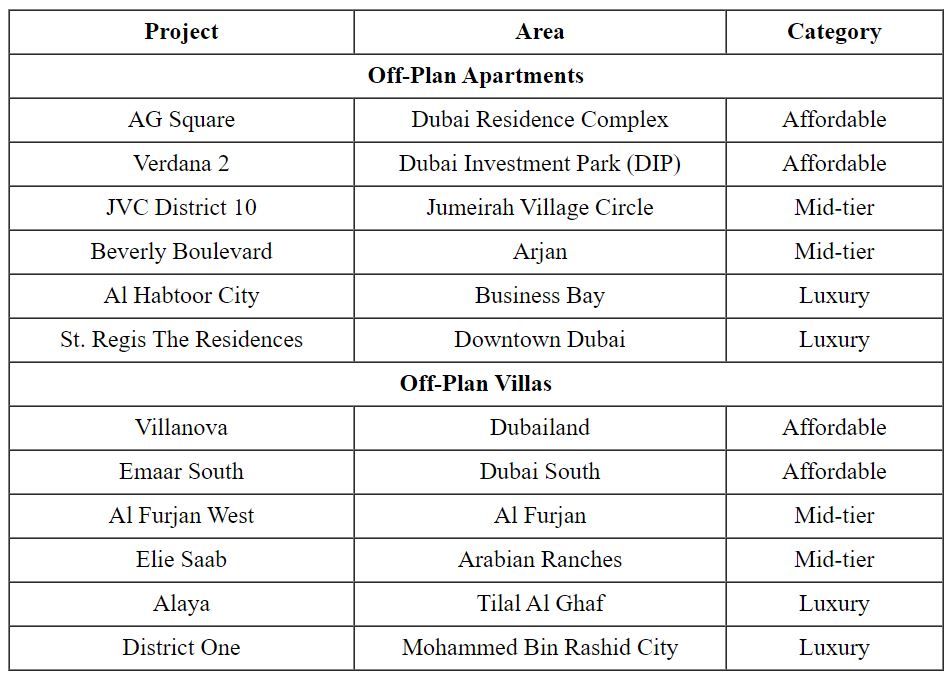

Off-plan properties involve buying while under construction – they offer investors discounts of 20-25% compared to completed units but require careful due diligence on project delivery risks. Payments are made in instalments and buyers can customise interiors and resell upon completion for attractive profits due to price appreciation over the construction period. Some of the top areas for off-plan properties in Dubai according to the 2023 market report by Bayut:

● Economic Outlook

Underpinned by a diversified, business-friendly economy forecast to grow over 3% annually, Dubai will continue attracting foreign professionals. Coupled with factors like tax incentives and low crime, the expanding middle class workforce will fuel real estate demand.

Conclusion

Dubai’s real estate has transformed from oil dependence to attracting global investors, cooled after 2019 but the Expo 2020 in 2021 reenergized growth. Recent sustainable trends and swelling demand now reward patient, informed residential investors who look beyond prime locations to high potential emerging areas while tightening regulations mandate due diligence.